Although the construction industry continues to grow, it may take up to 20 years for steel consumption in Southeast Asia to catch up with capacity growth in the region, SEAISI said at the 2019 ASEAN forum on sustainable development of the steel industry in Jakarta earlier this week.

Yeoh weejin, Secretary General of seaisi, expressed concern that ASEAN's steel capacity is increasing while steel demand is not growing accordingly.

He said that from January to June 2019, the apparent consumption of steel increased by 5.9% year-on-year, "to 39 million tons", of which flat steel consumption increased by 8.7%, while long material consumption increased by 3%. However, for the full year, steel consumption is expected to grow by 4% in 2019 to about 80 million tons, up from 5% in 2018.

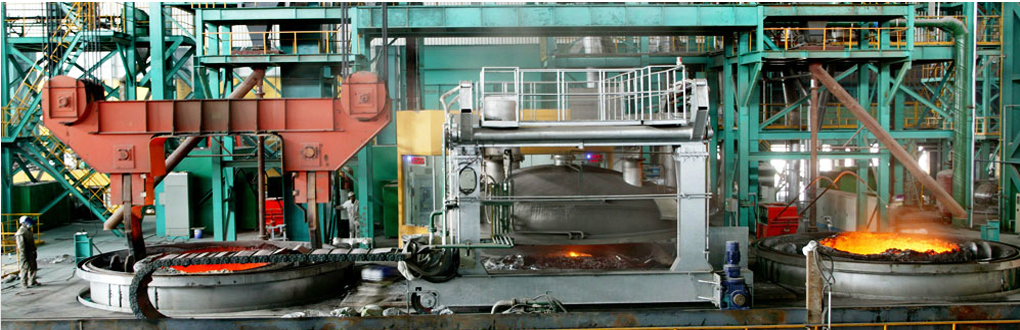

SEAISI forecasts that ASEAN's steel production capacity will increase from 83.7 million tons / year to 144.2 million tons / year by 2026, assuming "full load production of all integrated steel mills".

SEAISI said it would take about 18.6-20.1 years to digest the excess production, assuming steel consumption increased by 4 million tons per year.

"Many large integrated steel mills are being set up in Malaysia, Indonesia, the Philippines and Vietnam, with most of the investors coming from China," said SEAISI. He pointed out that China's steel investment in ASEAN began in 2017.

The analysis shows that due to the elimination of excess capacity, the steel profit margin has increased significantly. Since 2017, Chinese steel companies have accelerated their overseas capacity expansion plans.

In addition, Platts estimates that about 42.7 million tons of new overseas crude steel capacity is under construction each year, involving nine projects wholly or partially owned by Chinese steel enterprises. Five of the nine projects, including a capacity of about 35.5 million tons / year, will be built in Southeast Asia.