According to reports, as the South Korean government gradually tightens policies and regulations related to carbon emissions, the cost of carbon emission reduction for major companies in the country is soaring.

On April 10, according to statistics from the Korea Exchange, the country’s carbon emissions trading price was 21,000 won/ton (about $17/ton), a year-on-year increase of 36%.

It is reported that after the outbreak of the Russian-Ukrainian conflict, the EU carbon emissions trading price fell sharply, from 87 euros / ton (about 94.7 US dollars / ton) on February 24 to 58.3 euros / ton (about 63 US dollars / ton) on March 7 / ton), a drop of 49%.

Carbon prices rebounded to 80/t ($86.5/t) on April 8 as the Russian-Ukrainian conflict had a lower-than-expected impact on the European economy. According to the latest carbon emission legislation released by the Korean government, the free carbon allowances for Korean companies are expected to be significantly reduced.

It is reported that in 2015, South Korea's carbon emissions trading system introduced a free carbon quota allocation system. Among the 600 companies in the trading system, companies that emit less than their allocated amount can sell their remaining carbon credits, while companies that emit too much must buy additional credits from the market to meet emissions limits.

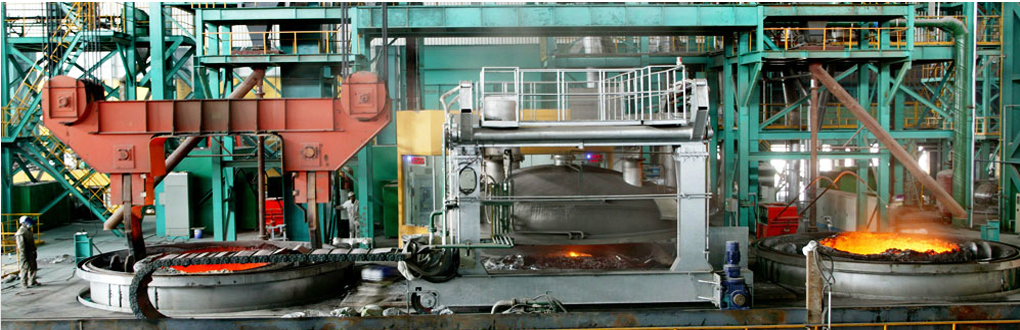

Data from the Korea Financial Supervisory Authority shows that in 2021, the carbon liabilities of the 50 most valuable manufacturing companies in South Korea (the fee for carbon emissions that exceed the quota) will be 294 billion won (about 240 million U.S. dollars). Among them, Kia Motors has the highest carbon debt (119.1 billion won), followed by Posco (84.3 billion won), Samsung Electronics (45 billion won), and Hyundai Steel (13.5 billion won) ranked fourth.