With the escalation of geopolitical conflicts, the backlash effect of European countries following the U.S. sanctions on Russia has become more and more clear. The shortage of energy supply has caused soaring production costs and soaring prices.

In this context, what will be the impact on local steel?

The price increase in the European steel market ranges from 30% to 50%. After reaching a peak in May, it continued to decline. It basically fell back to the starting point in August, and began to rebound in September. The European Commission said in a statement on October 6 that the European Council had adopted the eighth round of sanctions. The plan expands the ban on imports of Russian steel products, including semi-finished steel.

In fact, any ban on Russia would have an impact on the EU's steel industry. Because the EU is not only highly dependent on Russia's energy supply, more than 80% of its semi-finished steel products also come from Russia and Ukraine.

European HRC prices were still slightly lower on 11 October as demand remained subdued. According to relevant statistics, the Nordic HRC ex-factory index on October 11 was 718.75 euros/ton (about 711.76 euros/ton). In general, European HRC transactions have been light recently, with local dealers more focused on destocking.

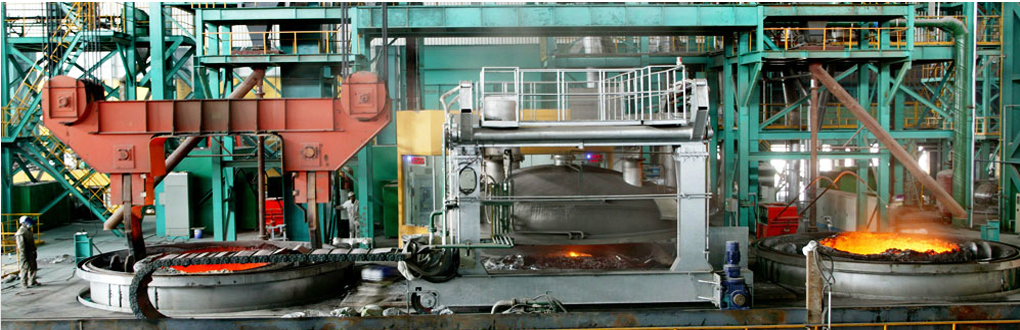

In addition, in the two weeks following the outbreak of the geopolitical conflict, the price of raw materials in the Italian industrial market has risen significantly. Not only that, 80% of Italy's steel production uses electric arc furnaces, and Italy mainly relies on natural gas and fossil fuels to generate electricity. It can be said that in such a large environment, Italy's steel industry is under pressure from many aspects.

British steel companies are also suffering from the impact of this round of energy crisis. British Steel has asked the British government to provide it with up to 500 million pounds (about 575 million US dollars) in a rescue plan to keep its steel plant in Lincolnshire running normally, or thousands of people will face unemployment. It is understood that the company is currently losing about 1 million pounds (about 1.1531 million US dollars) per day. About 100 million pounds ($115 million) of the company's proposed 500 million pounds bailout to the British government would need to be used to offset the cost of carbon permits.