On April 6, Vale announced that the company has entered into a partnership with J&F Mining Co., Ltd. (hereinafter referred to as the buyer) in relation to the sale of the company's shares issued by Mineraçäo Corumbaense Reunida S.A., Mineraçäo MatoGrosso S.A..

International Iron Company, Inc. and Transbarge Navegación Sociedad Anónima. All shares signed a binding agreement. The above-mentioned companies hold the iron ore, manganese ore and logistics assets of Sino-Western System. The agreement stipulates that the buyer must undertake all the rights and obligations of the "take-or-pay" logistics contract under the premise of the agreement of both parties.

Under terms of the deal, the deal is valued at approximately $1.2 billion, with a group of assets contributing $110 million to Vale's 2021 adjusted EBITDA (earnings before interest, tax, depreciation and amortization). It is reported that after the closing of the transaction, Vale will receive about 150 million US dollars and transfer to the buyer the "take-or-pay" logistics contract obligations and other obligations related to the transaction assets, subject to the agreement of both parties. In addition, the buyer will continue to operate on the premise of retaining all employees.

It is reported that Sino-Western System will produce 2.7 million tons of iron ore and 200,000 tons of manganese ore in 2021. The sale of Sino-Western System assets is guided by strict capital allocation, in line with Vale’s strategy of simplifying its investment portfolio and focusing on its main business. .

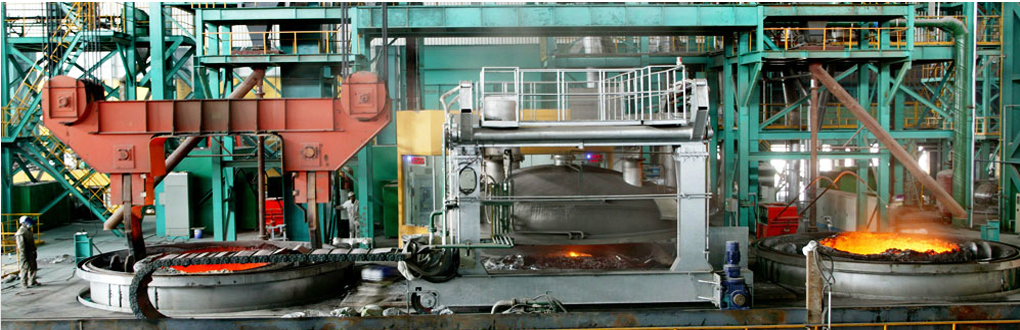

It took Vale 35 years to develop Tecnored technology, which eliminates the coking and sintering links in the early stage of steel production, reducing a large amount of greenhouse gas emissions, thereby accelerating the decarbonization process of the steel industry. In addition, the new plant can save 15% in costs because coking and sintering are not required with the Tecnored technology.